The Kelly Criterion

Diversify, diversify, diversify is the mantra often spoken by the financial community. Advisors will also give investors specific amounts they should be putting into each sector or each stock. Where does all this come from? It’s all actually coming from a money management system, and one of the most popular is the Kelly Criterion.

This system, which also goes by the name Kelly Formula, Kelly Strategy, and Kelly Bet is a way to manage money effectively by following a set of rules.

The following will describe exactly how the Kelly Criterion works, and how investors are able to use the system to improve their money management and asset allocation strategy.

Kelly Criterion Beginnings

The Kelly Criterion interestingly was not originally developed as a money management technique. It was originally meant as a way to deal with long-distance telephone signal noise. Developed by John Kelly for AT&T’s Bell Laboratory, it was published in 1956 as a paper entitled “A New Interpretation of Information Rate”.

Soon after the paper was published the gambling community somehow came across it and found that it had potential as a perfect betting system for horse racing. Through the use of the Kelly Criterion gamblers were able to maximize their bankrolls over the long term. Even today gamblers continue to use the money management system in horse racing and in casino games such as blackjack.

The Kelly Criterion has also become popular with investors over the years, including some big-name investors like Warren Buffet and Charlie Munger of Berkshire Hathaway, and the legendary bond fund manager Bill Gross.

Kelly Criterion Basics

The Kelly Criterion is comprised of two basic components. The first of these is the probability of a positive outcome, or a winning trade. The second is the total win loss ratio, which is made up of the total number of winning trades divided by the total number of losing trades.

These two factors are then input into the Kelly Criterion equation to derive the optimal trade size in relation to the probability of the trade being positive, despite the trend.

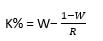

Here is the equation used:

Where:

K% = The Kelly percentage

W = Winning probability

R = Win/loss ratio

The output from the equation is called the Kelly Percentage, and it has many applications beyond portfolio management. Gamblers use this percentage to optimize their bet size, while investors use it to determine the amount that they should allocate to each individual stock, or to each market sector.

The Kelly Criterion in Use

Investors are able to put the Kelly Criterion to use by following five basic steps:

- Pull up your last 40-60 trades. A larger number will yield a more accurate result. You can get access to your past trades through your statement from your broker. Or, if you’re an advanced trader with a developed trading system you could simply run a back test on that system and use the results. Whatever method you use it’s important to understand that the Kelly Criterion assumes you continue trading in the same way you have in the past. If you change your trading system in any way it invalidates your Kelly Criterion results.

- Using the results from your past trades calculate ‘W’, which is the probability of a trade ending as a winner. You do this by dividing the number of winning trades by the total number of trades. The higher this number is, the better your winning percentage is. Any number above 0.50 (a 50% winning percentage) is considered good.

- Also using the same results from past trades calculate ‘R’, which is the win/loss ratio. You calculate this by dividing your average gain on winning trades by the average loss on losing trades. If your average winning amount is greater than your average losing amount you should get a result that’s larger than 1. If you get a result that is smaller than 1 it might still be manageable if the total number of losing trades is small.

- Once you’ve calculated W and R you can simply plug them into the equation given above.

- The output is the Kelly Percentage. Record this percentage to refer to later.

Interpreting the Kelly Percentage

The result will be a number that’s less than one, and it represents the size of the position you should be entering. To turn the number returned into a percentage simply multiply it by 100. So if the Kelly equation returns a number of 0.04 you would multiply it by 100 to get 4%.

This means you should have a 4% stake in each stock in your portfolio. Basically, the system is telling you how much to diversify your holdings based on your past performance.

One important caveat when using the Kelly Percentage is to use it with common sense. No matter what size position the Kelly Percentage is telling you to enter, never risk more than 20% of your total available capital on a single stock. Doing this inserts too much risk into your portfolio due to a lack of diversification.

Is the Kelly Criterion Effective?

The Kelly Criterion is a purely mathematical system, and should be able to be tested to see if it is profitable in the long run. Even so, many wonder how an equation originally developed for telephone systems can be effective when used in investing.

You could back test any use of the Kelly Percentage, and when simulating the growth of your account based purely on the mathematics of the Kelly Criterion you will find that it is an effective system. As long as the two variables are calculated and entered correctly to derive the Kelly Percentage, and the investor maintains the same system and performance in future trades, then the system is effective when used in investing.

Why Doesn’t Everyone Make Money with the Kelly Criterion?

While the Kelly Criterion and Percentage will help maintain a diverse portfolio it is far from perfect. It will diversify your portfolio, but there are a number of other things it will not and cannot do. For example, it won’t pick the proper winning stocks, and it can’t predict black swan events that lead to sudden market crashes.

Markets always contain an element of randomness that will have an impact on returns of any system.

In Conclusion

Money management is a good way to protect your account, but it can’t guarantee amazing returns. It can’t even guarantee that you won’t suffer losses from time to time. However, it can help to minimize losses when they do occur, and it can help to maximize your winning trades through its ability to efficiently diversify your portfolio.

If you’ve been looking for a money management strategy that will also help to diversify your portfolio then the Kelly Criterion might be just what you’ve been searching for.

Register for a trading account now to enter the markets,

or try our risk-free demo account.